For the next generation.

Backing founders who are reshaping their industries. For a sustainable next generation.

Waterdrop

Tasty hydration, made simple.

Drink more water. Founded in Austria, the company is shaking up the beverage industry with the world's first "microdrink" that is sugar free, damn tasty and saves up to 98% of plastic.

Share

Building the world’s leading social impact brand.

Your purchase does good - with immediate and direct effect! The social alternative for your everyday consumption: each purchased product contributes to a social project that has a positive impact.

MicroHarvest

Unleashing the Power of Microorganisms.

Growing demand for proteins require healthier and more sustainable proteins. Micro Harvest uses fermentation of microorganisms to create protein for the likes of pet food or animal feed, whilst reducing CO2 emissions.

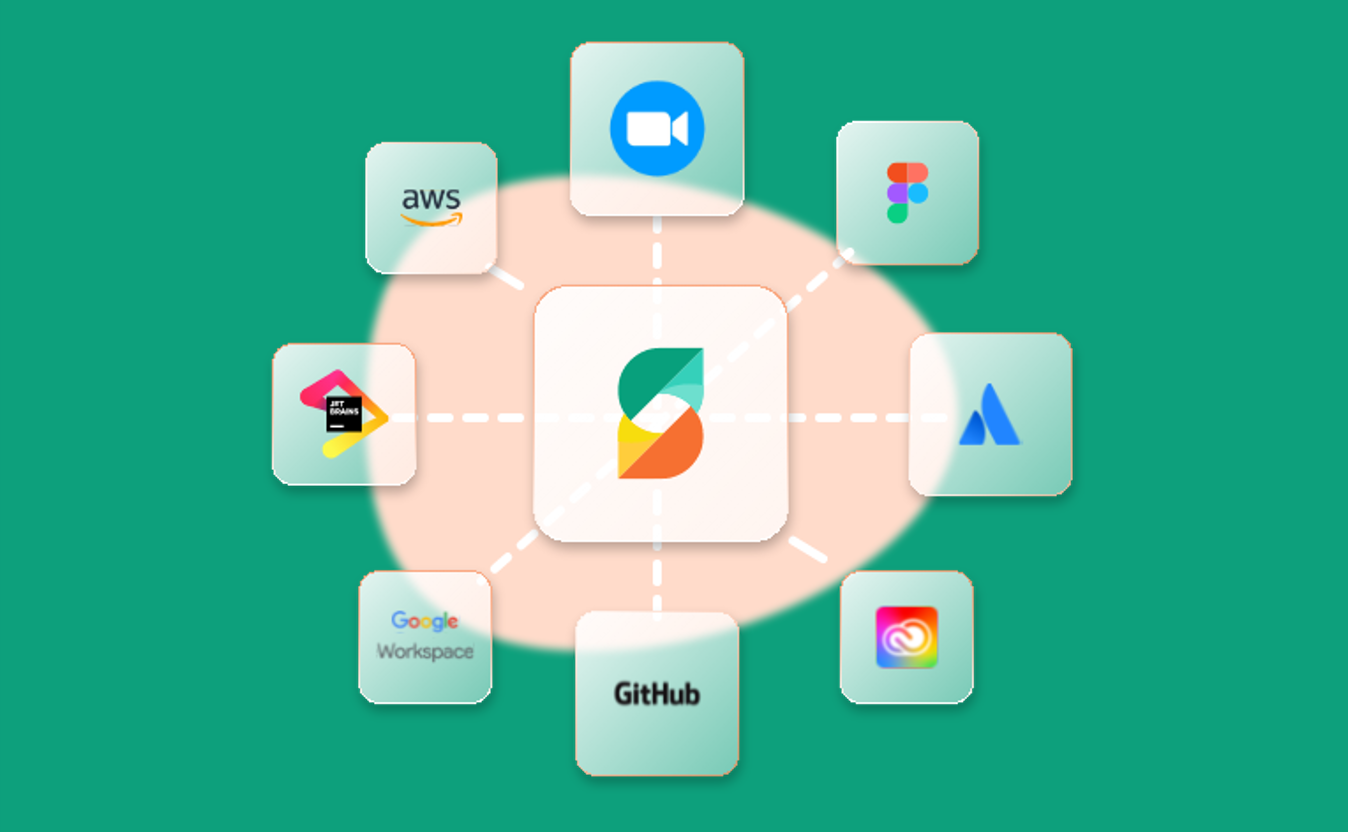

Sastrify

SaaS-Procurement, simplified.

Providing transparency in SaaS Procurement

Optimize and automate your SaaS procurement, usage, decision processes and license management

Holy

Supplying Hydration and Energy.

Healthy, functional powder-based energy and other softdrinks. Holy redefines the drinking experience—no taurine, no sugar, but loaded with electrolytes and minerals.

Supporting you from

Seed to Series A and beyond.

“Building up and managing growth at waterdrop is only possible with strong support. The Simon Capital team has been that reliable partner by contributing significantly through continuous sparring and network since day one in addition to their investment.”

Martin Murray, Founder and CEO Waterdrop

“Being on the mission to generate social impact through daily consumption with a wide range of consumer products comes with complexity. We are very happy, to have Simon Capital on our co-driver seat, who constantly supported us beyond financing wherever we need sparring.”

Ben Unterkofler, Co-Founder Share

"Simon Capital is not just a financial partner, but a true ally in our mission. They provide great support and their unparalleled know-how in industrial biotech and their network in the agri-food sector is instrumental to our journey towards making sustainable protein ingredients at scale a reality of today."

Katelijne Bekers, Co-Founder Micro Harvest

„With their extensive network into the VC ecosystem and the German Mittelstand, Simon Capital helped us with spot-on introductions to potential new clients and like-minded investors to help us build on our mission to create a SaaS procurement platform enabling transparency that ultimately saves time and money.”

Sven Lackinger, Co-Founder Sastrify

„Simon Capital has not only substantial know-how in D2C and consumer brand plays, but also is a true sparring on eye level when it comes to growth strategy.”

Frederick Jost, Co-Founder Holy

Using our powerful network and expertise rooted in an entrepreneurial family heritage to lift new generations of sustainable businesses.

We invest.

We invest in mission-driven founders that identify the needs of their customers with innovative business models and disrupting product solutions in order to shape a better and sustainable future for the next generation.

We support.

We believe ‘capital’ should be more than just mere money. Thus, we will provide capital beyond money in form of access to personal networks, industrial knowledge and entrepreneurial spirit. This support will last from Seed to Series A – and beyond.

Investment Thesis

Consumption.

Feeding the planet is the biggest societal and climate challenge in current times – solving this will be of pivotal importance for the upcoming decades. By inventing more efficient, healthy, and sustainable technology and product solutions, we invest into B2B and B2C consumption innovations that are better for the people and the planet.

Shaping.

Consumption.

Together.

Wellbeing.

Using state-of-the art scientific and technological advances, earth inhabitants’ lives are transformed towards more healthiness with respect to mental and physical conditions. Digital solutions are driving towards higher transparency, connectivity, and thus better performance creating superior living standards for the society.

Shaping.

Wellbeing.

Together.

Productivity.

Superior digital solutions along the value chain and innovative product experiences that disrupt analog businesses and ease complex processes with the aim to revolutionize existing segments or innovate new ones with the ability to adapt according to data will be key to safeguard the wealth and living on our planet.

Shaping.

Productivity.

Together.

We believe in sustainability as the base for lasting businesses. For the next generation.

Investment Portfolio

Lifestyle microdrinks and powerful global motivator to drink more water

Innovator for CBD and THC-based products in Europe

Healthy and functional on-the-go drinks based on sustainably packaged powder

The all-in-one SaaS procurement platform for agile teams

Alternative seafood

Transforming local brands into global household names

Clean label, plant-based meat replacement for sustainable nutrition

Leading data-based tracker for health conscious generations

Providing solutions against hair loss – full hair for a new self-confidence.

Door opener and must-use B2B Ordering Platform for kiosks

Changing the way we enjoy cocktails worldwide with alcohol free spirits and RTDs

Sustainable proteins of the future, harnessing the power of microorganisms

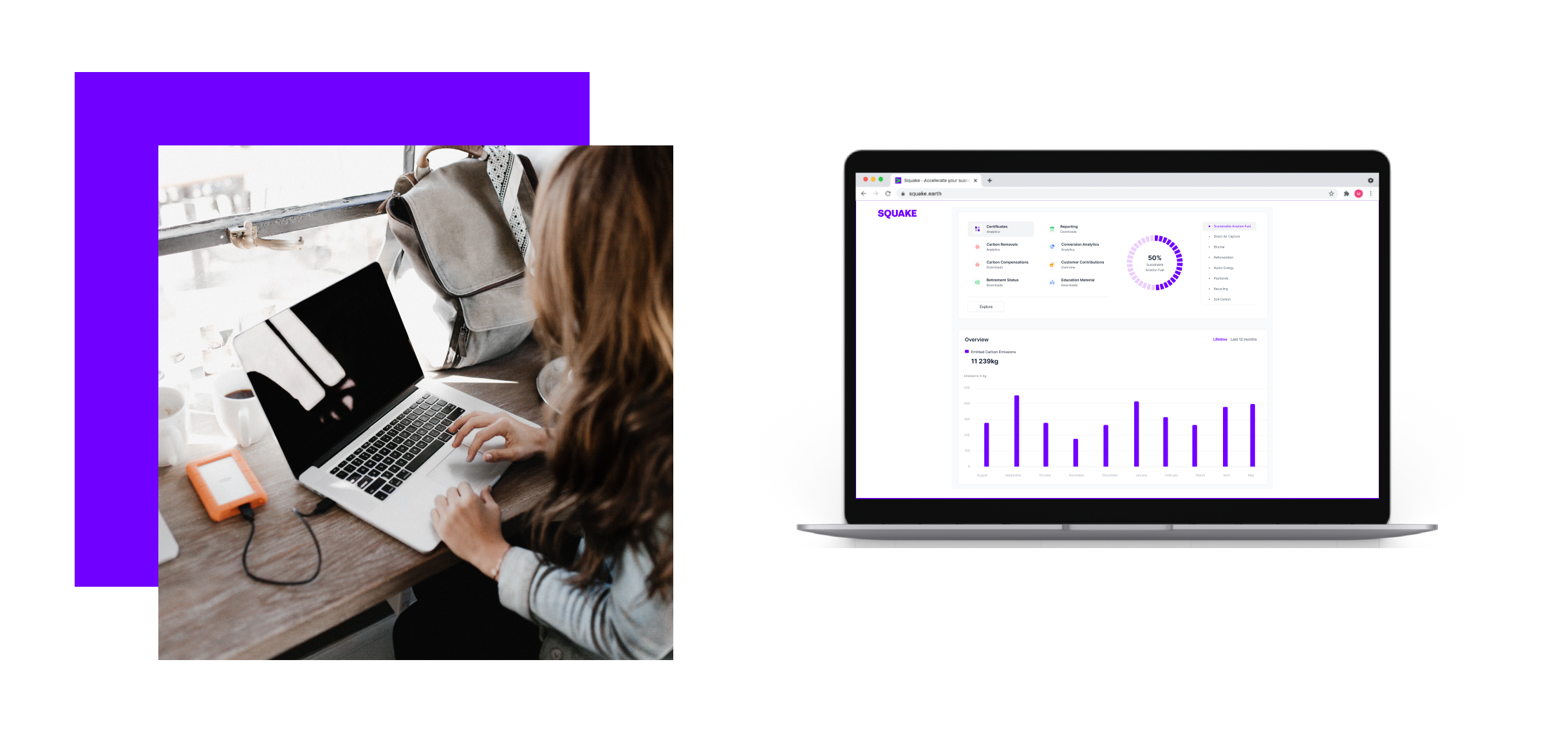

PnP technology for carbon calculation & curated CO2 compensation

Holistic tool for efficient management of (flexible) employees

Collegial AI Tool for customer support teams

Embodiment of impact-driven, social consumption in our modern society

Voice AI for Quick Service Restuarants

Interactive math learning toy with playful activities

Medical eye treatments, including refractive surgery or cataract surgery

Past Investments

Leading digital spice love brand and social media food channel

Future of sustainable and healthy Water consumption

Smart micro market solution to offer modern and healthy food

Plant-based dairy alternative with proprietary technology

Plant-based pet food saving substantial packaging resources

Leading health and love brand around nut-based products

End-to-end digitized solution and process to produce milk-free casein

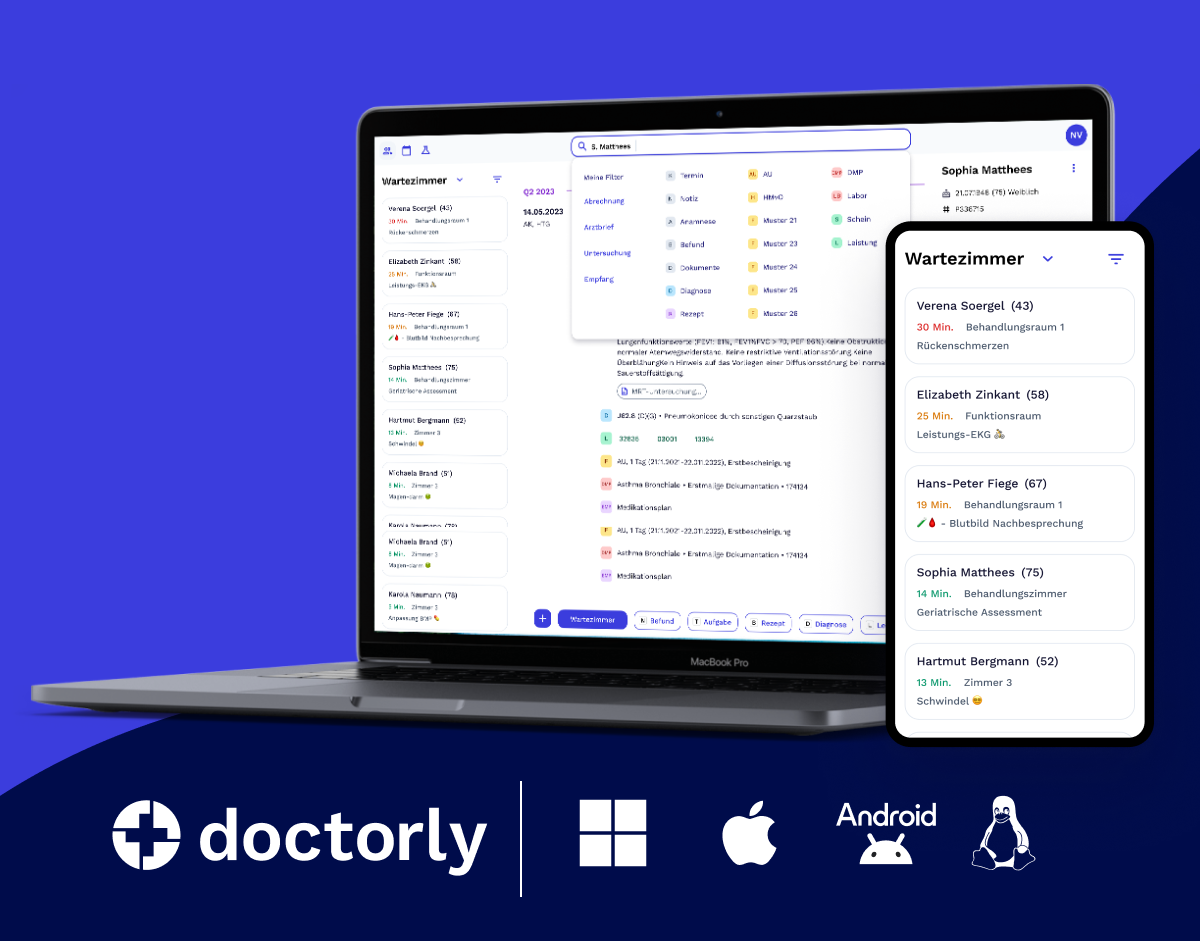

Medical practice software

The investments marked with an asterisk were made by the investment team of Simon Capital GmbH & Co.KG for the Bitburger Ventures GmbH Portfolio. Bitburger Ventures GmbH is a limited partner (Kommanditistin) of Simon Capital GmbH & Co KG.

Strong partners

Offering access to a unique set of industry and venture networks.

Expert Access

Thanks to a highly diversifed network of industry leading companies of our investor, we have access to a unique set of industry and venture networks that we leverage for investment decision making and actively offer our investee companies as value-add in addition to our financial contribuionts. We understand ourselves as an accessible, reliable, and collaborative team – we remain on the co-driver seat beyond stages.

Powerful Network

In the past years we have built up a highly diversified and valuable network of trusted partners and co-investors. In addition to our direct investments, we are also invested into leading early-stage funds, with whom we have co-invested in the past and will also do in the future. These networks give us access to world-leading early-stage co-investors and know-how.

Lasting Commitment

There is no ‘short-term’ in family. So being backed by one of the most renowned family businesses in Germany comes with lasting dedication. We are here to stay and will continue to invest in the foreseeable future thereby leveraging our experiences and expertise.

Shaping Beyond Investing.

Infitine Roots

Believing in a food system that provides accessible nutrition for everyone, Infitine Roots is creating the next generation of sustainable, healthy, and delicious food products form mycelium mushrooms.

with Cathy Hutz,

Founder Infinite Roots

Just Spices

Good food makes you happy! By creating the most delicious spice blends, Just Spices brings the culinary diversity of the whole world to the plate of its customers.

with Ole Strohschnieder,

Founder Just Spices

Ordio

Ordio replaces paperwork, Excel sheets and disconnected tools with one clean platform. Shift planning, time tracking, absence management and now fully automated net payroll – everything in one place.

with David Keuenhof,

Co-Founder Ordio

We are a team of highly motivated, well-experienced investment professionals.